April 20, 2023

Take Control of Cloud Spend with the Power of FinOps

FinOps: The Key to Managing Cloud Spend

FINOPS: THE KEY TO MANAGING CLOUD SPEND

Cloud computing has changed the business landscape. It enables better innovation, more flexibility and an attractive pricing model for businesses of all sizes. Not to mention it has kept business going remotely during the pandemic. However, if organizations are not careful, they can quite easily go over budget and suddenly find that their cloud spend is spiraling out of control.

What’s more, centralized IT purchasing as we know it is gone. In the world of SaaS solutions, departments and teams within an organization are able to add and remove licenses without RFPs, POs or interacting with purchasing departments. The cloud marketplace complicates this picture further, as organizations will no doubt need to manage bills from multiple cloud vendors. This means that budgeting and cost tracking across an organization’s cloud spend is nowhere near as easy as it should be.

This white paper will provide an instructive guide to cloud financial management, aka FinOps. We will outline why you should implement FinOps at your organization, and then highlight the benefits of teaming up with a cloud partner to provide the added value, IP and expertise to ensure you’re 100% in control of your cloud spend.

The right cloud partner can make all the difference. It’s time to get hold of cloud spend once and for all. Cloud partners such as CDW are here to help.

An Introduction to FinOps

Cloud migration is at the heart of every digital transformation project. Moving forward, organizations will find it hard to remain operational without moving key infrastructure to the cloud. But how you go about migrating to the cloud, how you manage and optimize it over time, is even more important than simply getting there.

MANAGING CLOUD SPEND IS CRUCIAL

A key part of any cloud migration is cost management. If you move to the cloud without the right planning, you’ll soon discover you’re not receiving the cost benefits promised. If it takes the shock of an enormous and unexpected bill to figure out your cloud setup isn’t optimized, it’s probably too late.

This is where FinOps comes in. FinOps is the financial management of your cloud spend. Essentially, it’s a set of principles and practices to make sure nightmare bills never arrive. FinOps teams are increasingly becoming a fixture at leading organizations.

When is the best time to start FinOps? Ideally, you start before moving anything to the cloud. For many businesses, however, this step is missed long before their migration begins. If you’re already deep into your cloud journey, it’s that much more important to implement a FinOps strategy as soon as possible.

In fact, FinOps is perhaps most needed by organizations which are far down their cloud journeys. Organizations with high cloud spend and complex multicloud environments are most in need of cloud financial management. So too are large organizations with large numbers of users, teams and workloads. But FinOps is a highly valuable model for all organizations in a world where success is dependent on digital technology.

FINOPS: A DEFINITION

The FinOps Foundation defines FinOps as: “…the practice of bringing financial accountability to the variable spend model of cloud, enabling distributed teams to make business trade-offs between speed, cost and quality.”

In our words, FinOps is the strategy, management and ongoing execution of everything that goes into ensuring your cloud is cost-effective. This ideally means sitting down at the very beginning of any cloud project and working out how to control cloud spend in order to receive optimal return on investment. Or it means taking a strategic look at current cloud setups and systematically implementing a series of principles and practices to better manage and optimize these. Now to the main principles of FinOps.

A MATTER OF PRINCIPLE(S)

Centralized

FinOps models aim to centralize cloud management. To make better, data-driven decisions about cloud spend, it’s best to have all the information and tools you need in one place. This is crucial for visibility, but also for accessibility. A centralized approach means everyone can see everything that they need to manage cloud spend.

Organization-wide

The importance of organization-wide collaboration cannot be understated. Most organizations will implement a singular entity for leading FinOps, but it must unleash a culture change that sweeps across the entire organization. Many FinOps professionals say that one of the biggest barriers is getting colleagues to help implement the required changes. When a whole organization relies on the cloud for productivity, it’s the whole organization that needs to work together to understand what, why and how cloud costs can spiral out of control.

Business Value

Putting business value first ensures that FinOps teams focus on the wider objectives of the organization. Is the end goal digital transformation? No, it’s the added value gained by that investment in digital technology. It’s a competitive edge, an award-wining customer experience or a growing employee satisfaction score. But ultimately, it’s a boost to the bottom line.

Flexibility

FinOps takes advantage of the flexibility of the cloud. One of the main advantages of cloud cost models when compared to traditional on-premises IT is the flexibility. Organizations can scale up and down cloud services as and when needed, meaning you only pay for what you use. So it’s no surprise that FinOps teams are in the business of stretching this flexibility to its limit to gain better outcomes.

Visibility

We’ve saved the most important for last. Successful FinOps initiatives rely on accessible and timely reporting, so that any anomalies and fluctuations in cost are flagged. This means dashboards and data, yes, but it also means automation to ensure the right data is collated in the right way at the right time — and that it is done efficiently.

Cloud Adoption Framework (CAF)

Both Amazon and Microsoft leverage what’s known as CAF, or the Cloud Adoption Framework. For organizations using cloud technology, the CAF framework should be seen as the North Star. CAF is a comprehensive guide on how a company should set up cloud IT.

Many companies move to the cloud in an ad hoc or haphazard manner, without any guiding framework. CAF provides this framework, and there is a lot of crossover with the FinOps principles outlined above. We’re not going to go into detail explaining CAF here, but it’s worth knowing that one of the benefits of joining forces with a cloud partner is their expertise in this area. They will know the framework like the back of their hand, so you don’t have to read what is quite a formidable document.

How to Build a Team of FinOps Superstars

Successful cloud financial management should involve many areas of an organization. You need to establish a skilled and diverse team to lead FinOps — diverse in the sense of bringing different skills from different areas of the business. Getting buy-in from as wide a group as possible is a good idea.

Otherwise, challenges and stumbling blocks can emerge from colleagues and departments who don’t necessarily understand the value of the work the FinOps team is driving through.

And so FinOps often requires a cultural shift for it to be effectively implemented.

WHO NEEDS TO BE INVOLVED?

Business Leadership Team

Buy-in from the top is always important in an initiative like FinOps. But crucially, without the boardroom and C-suite singing from the same hymn sheet as the FinOps team, you will keep coming up against the same barriers to change.

Engineering/Operations

One of the most cited impediments to FinOps success is lack of participation from developers and engineers. It’s important to incentivize these colleagues who are intimately involved in cloud management and deployment. If anyone needs to participate in cloud cost management, it’s them. And if anyone’s going to get in the way of your progress, even if unintentionally, it’s them.

Finance

It should be easy to get finance on board with the FinOps agenda, but it doesn’t always work out that way. But if finance can be persuaded of the benefits of FinOps, and if they understand how central the cloud is to operations and how easy it is for cloud spend to get out of control, they will be eager to help.

The FinOps Team

FinOps teams are made up of a variety of roles and backgrounds. Some have roles dedicated to FinOps but others include IT, engineers/DevOps, CIOs, finance and procurement. Often these teams are small (four people on average) but are growing as FinOps demonstrates its value. According to the FinOps Foundation, a significant proportion of FinOps team members are also part of their organization’s Cloud Center of Excellence. This shows that FinOps tends to be given the green light at businesses that already take the cloud and cloud spend seriously.

Outside Help Can be a Game Changer

For FinOps teams to realize the potential of these principles, it can be beneficial to partner with a third-party organization. Cloud partners can offer a range of services and solutions that would be too expensive to implement internally.

Ideally, you want to establish a diverse team that includes people from IT, Purchasing, Finance and more, who can focus part of their time on FinOps.

Cloud Partners vs Cloud Providers

It might seem like a matter of semantics on the surface, but the differences between cloud partners and providers is substantial. Where a cloud provider is in the business of selling cloud solutions or products, a cloud partner is in the business of making the cloud work for you.

Now, there will be many organizations that fit somewhere in the middle. You’ll come across plenty of companies who sell the cloud and then provide minimal services on top, just to make sure their customers are up and running. A cloud partner goes above and beyond this, however.

A partnership is mutually beneficial. It involves trust. It relies on two organizations coming together to achieve a shared goal. A cloud partner will go above and beyond to ensure your cloud is tailored to your organization — your people, culture and business objectives. What’s more, they have passionate people with specialist knowledge to help you achieve your digital transformation outcomes.

There are also cloud partners such as CDW that own their own IP, i.e., solutions and services that provide exclusive added value, often for the particular problem you need solved. In the next section, we will explore how CDW provides an unrivaled package for FinOps success.

CDW: A Cloud Partner that Offers Extra

The benefits of a trusted cloud partner are clear: the expertise, the experience, the safe hands, the practical know-how of succeeding at these kinds of projects again and again. But no two cloud partners are the same; we’re not all created equally.

At CDW, we take pride in our award-winning services and solutions, and in our ability to cover all FinOps bases alongside your team. Wherever you are in your cloud journey, our solutions provide functionality to migrate and manage cloud spend.

Here’s the CDW approach to FinOps and what we offer as a cloud partner.

THE CLOUD FRAMEWORK

First, the North Star. Every cloud project we work on for our customers adheres to the Cloud Adoption Framework (CAF) 100% of the time. This meaty instruction manual gives you everything you need to get up and running effectively in the cloud, including cost management and governance. The only problem is it’s too dense and vast for most busy professionals to read.

That’s where CDW comes in. It’s our job to know this stuff. In fact, we built our business around it. We can guide your FinOps team in the ways of CAF. And what’s more, all our solutions and services will help you achieve your cloud financial management goals in line with the CAF framework.

INSCAPE™ CLOUD MANAGEMENT & VISIBILITY

For FinOps to succeed, it requires visibility and clarity. The governance solutions that come out-of-the-box with Microsoft applications and services are not up to scratch, whether it’s Microsoft 365, Azure, AWS or GCP.

This can lead to complex workarounds for IT teams — one reason why getting IT engineers and developers on board with FinOps has often proven difficult. Your IT team might have to automate data discovery or build custom applications for greater visibility; both are time- and cost-intensive tasks.

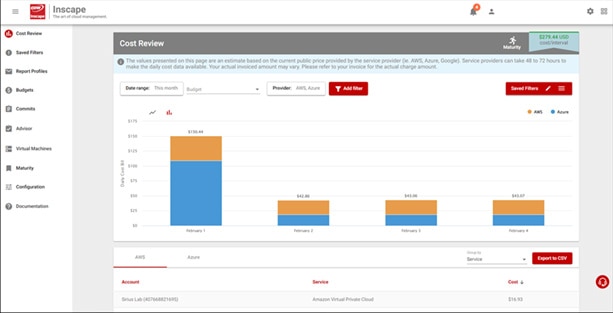

When you partner with CDW, you get access to Inscape, a suite of solutions that take care of all this and more. We’re going to focus on Inscape Cloud Management, which provides a financial snapshot of spending across all cloud spend, including from multiple cloud vendors. It also gives you access to detailed billing information and cost reporting at the click of a button, which will eliminate the task of examining spreadsheets and dissecting cloud bills.

With a couple of clicks, you can see your entire cloud spend — how much you are spending in Microsoft 365, Azure, Azure reservation and more. Then, with another click, you can see the same for Amazon Web Services (AWS). Everything is presented in one downloadable invoice, organized clearly by date, and can easily be exported. This provides comprehensive cost visibility, transparency and reporting across your Microsoft, GCP and AWS environments.

Pre-built dashboards, graphical charts and insights help you easily consume and intelligently analyze data. The budgeting dashboard offers visibility into your monthly costs and target thresholds — and you can slice and dice your cloud spend by account, service, resource, etc., for granular cost visibility.

Additionally, you can also create and manage a budget for your entire cloud spend. Our cloud agnostic budgeting tool allows you to create cost reviews and track enterprise discount plans (EDPs) across every cloud vendor.

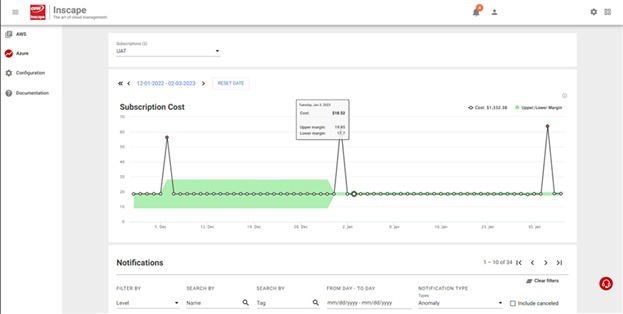

INSCAPE ANOMALY

Everything seems perfect; you have set up a dedicated team for FinOps, you have taken the time to follow CAF, you have set up solutions such as Inscape Multicloud Cost Management to provide visibility across multicloud solutions. But then your cloud bill arrives and you wonder why it’s so high. What happened? Anomalies, that’s what.

Runaway code queries can consume compute without anyone knowing, regardless of how well you followed CAF and perfected your budgeting.

It could also be caused by human error. Someone forgets to turn a program off and it runs all month in the background, without anyone noticing.

And there’s the risk of malicious actors or malicious code triggering activity out of view.

Traditionally, the only way to discover anomalies was when your bill arrived. No matter what you did, you couldn’t prevent it … until now.

Inscape Anomaly is the final part of CDW’s FinOps package. Inscape Anomaly monitors activity across your systems, detecting and reporting any anomalies that lead to abnormal cost spend. Anomalies will be flagged so that you can stop them from spiraling out of control. People often lament the hidden costs of the cloud. With Inscape Anomaly, you can finally say goodbye to hidden costs.

Take Control of Cloud Spend with CDW

The cloud is at the center of everything your organization does. Therefore, it makes a lot of sense to make the management and optimization of cloud spend a priority.

FinOps is the best set of principles currently available for organizations to make cloud costs work for them. A cloud partner can take this to the next level, ensuring your organization gains full control over cloud spend.

CDW provides the solutions and services — not to mention the expertise and experience — to optimize cloud costs, and make sure you realize the full potential of the cloud without suffering unnecessary costs. The cloud should work for you and within your budget. CDW’s Inscape suite provides the cloud management, governance and optimization tools for ultimate FinOps success.